Bitcoin is up over 150% in 2023, and that momentum has captured hearts and minds on Wall Avenue, leading to a landmark rush for its companies to launch the first-ever Bitcoin exchange-traded fund (ETF).

All eyes are actually on the upcoming choice by the U.S. Securities and Alternate Fee (SEC) concerning the approval of a spot Bitcoin ETF, slated for January 10.

If the previous is any indication, the ruling could have a big affect on Bitcoin’s worth, although whether or not optimistic or destructive stays to be seen.

Potential for a Worth Rise

Proponents of a Bitcoin ETF argue that its approval by the SEC would open the door to a flood of institutional and retail investments, driving the worth of Bitcoin to new heights.

Historical past affords a glimpse into how expectations surrounding ETFs have affected Bitcoin’s worth.

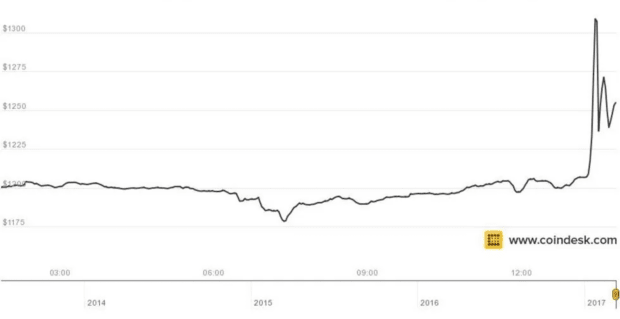

In 2017, the worth of Bitcoin surged to over $1,400, pushed partially by the anticipation of the primary Bitcoin ETF. This was up from lows within the $600 vary simply the 12 months earlier than.

Traders believed then that the introduction of a Bitcoin ETF would make it simpler for institutional cash to enter the market, resulting in a frenzy of shopping for. Nonetheless, the SEC finally rejected the proposal, inflicting a pointy decline in Bitcoin’s worth.

Inside days, the worth was buying and selling again under $1,000.

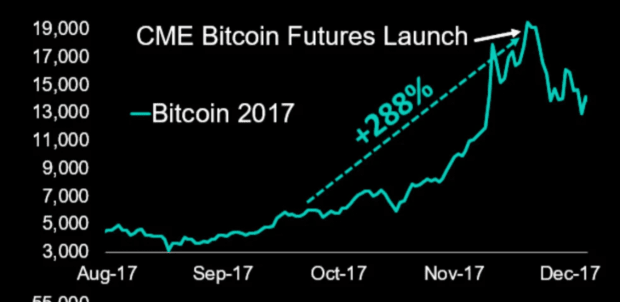

Finally, nevertheless, the arrival of Bitcoin futures would carry new consideration in 2017, the market surging above $20,000 that 12 months.

Elsewhere, we are able to quick ahead to 2021, when Bitcoin as soon as once more rallied to all-time highs, reaching over $60,000.

This time, the rally was partly fueled by the profitable launch of Bitcoin futures ETFs in Canada and Europe. These ETFs allowed traders to achieve publicity to Bitcoin with out holding the cryptocurrency straight. The anticipation of an identical product within the U.S. contributed to the bullish sentiment.

Lastly, within the wake of pretend information of an ETF approval earlier this 12 months, Bitcoin’s worth rose by a number of thousand {dollars} in minutes, a transfer that implies upside volatility on approval is probably going.

Potential for a Worth Fall

On the flip aspect, there are arguments suggesting that the approval of a Bitcoin ETF may result in a worth correction.

Some market consultants concern that the ETF may develop into a goal for brief sellers, resulting in elevated volatility, or that the ETF may very well be a “promote the information occasion.”

Furthermore, the approval of a Bitcoin ETF might carry higher regulatory scrutiny to the cryptocurrency market as an entire. This heightened oversight may result in elevated taxation, reporting necessities, and potential restrictions on the usage of Bitcoin, which can dampen enthusiasm amongst traders.

Moreover, some imagine the market might have already got priced in the potential for a Bitcoin ETF approval, and any choice to disclaim it would result in disappointment and a sell-off much like what was witnessed in 2017 when the Winklevoss Bitcoin ETF was rejected.

The ultimate choice by the SEC is eagerly awaited by the crypto neighborhood, nevertheless it’s important to do not forget that it is only one of many components influencing Bitcoin’s worth.

Market sentiment, macroeconomic circumstances, and geopolitical occasions may also play their half in shaping the coin’s future.

Conclusion

In conclusion, Bitcoin’s worth is at a crossroads as traders await the SEC’s choice on the Bitcoin ETF.

Whereas previous cases have proven that ETF expectations can have a considerable affect on Bitcoin’s worth, it’s essential to contemplate the broader market dynamics. Whether or not Bitcoin’s worth rises or falls after the SEC ruling will rely upon a mess of things, together with how the market interprets and reacts to the choice.

Because the crypto world holds its breath, the way forward for Bitcoin stays unsure, nevertheless it’s undeniably a pivotal second for the world’s solely decentralized cryptocurrency.

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000