Dogecoin (DOGE), the meme-driven cryptocurrency, stays confined inside a slim buying and selling vary of $0.075-$0.088 because the starting of 2024, leaving traders grappling with its future trajectory. Whereas exercise has dwindled in comparison with early 2023, a good portion of DOGE addresses stay worthwhile, fueling cautious optimism.

Worthwhile Addresses Supply Glimmer Of Hope

Roughly 60% of DOGE addresses, totaling roughly 1.34 million, at present maintain their tokens at a revenue, implying they purchased at decrease costs. This knowledge, gathered by blockchain analytics agency IntoTheBlock, suggests underlying bullish sentiment regardless of declining market engagement.

Technical Help And Resistance Ranges

Analysts spotlight key help ranges round $0.077-$0.079, the place numerous traders entered the market. This zone might act as a shopping for ground, stopping additional value depreciation.

Nevertheless, breaching this help might set off a dip to $0.07, providing potential entry factors for bargain-seeking traders. Conversely, overcoming the $0.088 resistance degree might pave the best way for a value climb in the direction of $0.094.

BTCUSD buying and selling at $50,093 on the every day chart: TradingView.com

Dwindling Exercise Raises Issues

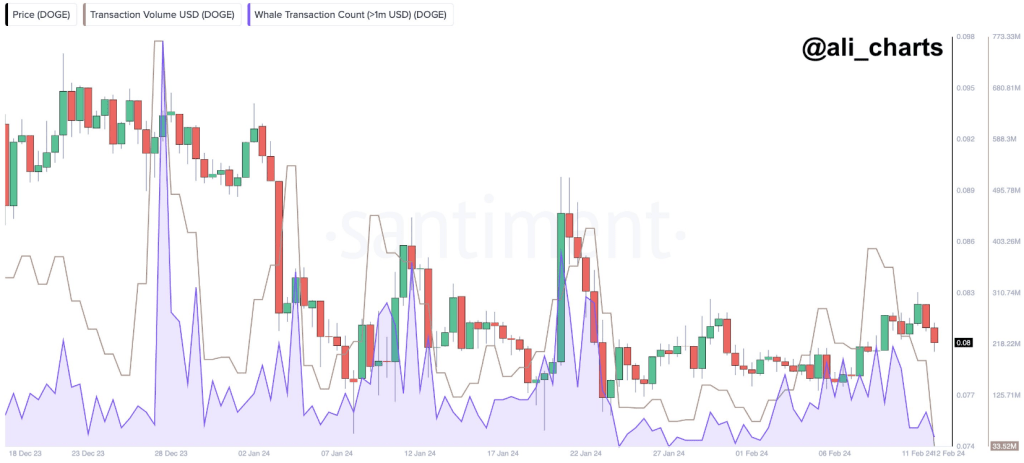

A more in-depth have a look at community exercise paints a much less rosy image. Each transaction quantity and whale exercise, signifying large-scale investments, have decreased considerably, indicating decreased buying and selling curiosity. This lack of enthusiasm might hamper Dogecoin’s upward momentum.

#Dogecoin is experiencing a lower in transaction quantity and whale transaction rely, which usually signifies decrease buying and selling exercise. This could possibly be an indication that fewer individuals are shopping for, promoting, or transferring #DOGE, probably on account of decreased curiosity or confidence in it! pic.twitter.com/SiKNxx4FhN

— Ali (@ali_charts) February 12, 2024

Technical evaluation reveals a stalemate between the 50-day Exponential Shifting Common (EMA) performing as help and a falling trendline performing as resistance. This sample indicators an absence of clear path within the close to time period. Flipping the trendline to help could possibly be a constructive indicator, however reaching that requires renewed shopping for strain.

Valentine’s Day Prediction Presents Modest Hope

Crypto change Changelly provides a average prediction for Valentine’s Day, forecasting a 1.12% value enhance to $0.082591. Whereas this might carry momentary cheer to DOGE holders, it additionally underlines the foreign money’s sensitivity to market sentiment and general volatility.

Dogecoin: Lengthy-Time period Issues Linger

In the meantime, Dogecoin’s latest fall from the highest 10 cryptocurrency rankings raises issues about its long-term viability. Not like opponents providing real-world purposes, DOGE primarily depends on superstar endorsements and web traits. This raises questions on its capacity to compete within the quickly evolving crypto panorama.

The way forward for Dogecoin stays unsure. Whereas a short-term value rise is feasible, issues about its utility and aggressive edge in comparison with different tasks persist. Traders ought to method DOGE with warning and conduct thorough analysis earlier than making any funding selections. Keep in mind, value predictions are merely educated guesses, and the cryptocurrency market stays inherently unpredictable.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site totally at your individual danger.

More NFT News

El Salvador Boosts Bitcoin Purchases After IMF Settlement

No, BlackRock Can't Change Bitcoin

Canine Memecoins Rebound as Bitcoin Reaches $98,000